| Issue N° 1 - January 2008 |

||||||||||||||||||||||||||||||||||

|

Shanghai's Power and Gas Situation

Download Shanghai Flash N° 1/2008 pdf-version 1. Energy demand in Shanghai (1) Composition of energy demand (static analysis) Looking at the nation's per capita energy consumption, China still consumes only 30 percent of the average of OECD countries. This is equivalent to three quarters of the world's average per capita consumption. Although this fact might seem reassuring, these statistics hide a great discrepancy between rural and urban regions. Although China has a high electrification rate of 99 percent, coastal regions made up for 74 percent of energy demand in 2005. The increasing wealth concentrated in these regions is surely one explanation. Urban per capita disposable income is now reaching 22'808.6 RMB (3'150 USD) in Shanghai. As the Chinese middle-class develops, increasing numbers have spurred their energy consumption by moving to more comfortable modern housing and purchasing home appliances. Especially air conditioners, which are purchased in priority by households (1), can account for 40 percent of the peak load during summers in Shanghai. Household energy consumption, however, is not the main driver of Shanghai's hunger for energy. A great part of energy demand stems from the industrial sector. China consumes four times more energy per dollar of GDP than its neighbour Japan. This is not only due to a loss of energy in all steps of the energy chain (2) but also mainly because of China's industry bias towards energy guzzling heavy industries. In fact, energy intensive sectors such as iron, steel or aluminium make up for 28 percent of industry demand. The non-metallic industries, as well as the chemical and petrochemical sector respectively constitute 23 percent and 15 percent of industrial energy use. On average, firms from the industrial sector now spend 10 percent of their operating costs on energy bills. This percentage can even reach 30 to 45 percent in the petrochemicals and construction (cement) business. (2) Government steps in reducing energy consumption Although the Chinese government's priority has long been GDP growth and raising living standards, it is trying to make China's development less energy intensive. A series of measures to reduce energy consumption have been launched on state level. The Communist Party's 11th year plan for the period 2006-2010 includes the target to reduce energy intensity by 20 percent by 2010, compared to 2005 levels. This goal is very ambitious, especially because of the intrinsic energy intensity of China's core industries. Significant regulatory steps have been taken in improving energy efficiency standards and limiting the expansion of energy intensive sectors. The Chinese Government, as well as the Shanghai Municipality, have committed to issuing energy-saving and environmental standards for a whole range of energy consuming products. In its Implementation Plan for Energy-Saving and Emission-Reduction Work, the Shanghai Municipality has stated it would quicken its formulation of local standards and technology specifications in 2008. In fact, energy efficiency measures in the construction sector could potentially contribute to 30 percent of total energy savings until 2010. Compulsory energy efficiency regulations and standards for new public and office buildings have been put into place nationwide in 2006. Shanghai Municipality, in particular, has committed in 2007 to implement the standard that newly erected buildings shall follow a binding energy-saving 50 percent standard and would like to soon extend it to a 65 percent standard. Reaching the standard should be the precondition for getting a construction permit. Shanghai would also like to transform all public and government buildings (3) into energy-saving buildings to give a good example to the construction industry. With these measures, Shanghai expects to reach its building energy saving goal of 15 percent, as well as the target to reduce the energy used by government organs by 20 percent during the 11th Five Year Plan. However, a study by the Chinese Ministry of Construction has shown that only 53 percent of the newly constructed buildings meet the set standards of energy efficiency. Although respecting energy-saving standards would only increase building costs by 5-10 percent, many real estate developers are unwilling to bear the costs, favouring short-term profits over long-term considerations. In most of the cases, however, investment in energy efficiency would even bring short-term benefits. ABB estimates that the payback on many energy efficient technologies is very often reached after one year, although they involve high initial investment costs. For buildings, ABB estimates the pay-back time to lie between two and three years. This shows that a change of mentality and a sensitization of the population towards sustainable practices are needed. Government measures have also been taken to limit heavy industry exports and to expand the service sector. Indeed, the IEA estimates that energy use for the production of export goods accounts for one fourth of Chinese energy demand. Hence, this move is particularly relevant for export-oriented coastal regions like Shanghai, Jiangsu, Zhejiang and Guandong which account for 70 percent of China's exports. As for the tertiary sector, Shanghai Municipality wants to lay a top priority on the development of the service sector, especially of finance, modern logistics, information service and cultural industry. These areas are not only less energy intensive but also of higher added value. The IEA calculates that this shift towards more service orientation could reduce the energy demand of coastal regions from 74 percent in 2005 to 57 percent in 2030. (3) Growth trends The reduction of energy consumption achieved by improving energy efficiency and restraining the development in heavy industries, however, is assessed to be meagre when compared to the surge in additional energy demand. A good example is the power sector, which accounts for 53 percent of the energy demand's increase. Shanghai Municipal Power Company (SMEPC), Shanghai's dominant power supplier, expects electricity demand in Shanghai to grow at an average rate of 10 percent per annum over the next 10 years. The IEA, from its side, predicts that electricity consumption in China will increase 3.5-fold between 2005 and 2030. This tremendous growth in energy and especially power demand poses challenges to supply security. Power supply problems were still widespread in the last years. A peak happened in the years 2003-2004 during which 24 of the 31 Chinese provinces, municipalities and autonomous regions were subject to planned power cuts during summertime. Factories and other firms were forced to close down for up to a week alternately. The shortage situation, however, has considerably improved since 2007, due to massive investments in power generation and transmission. 2. Power supply in Shanghai (1) Main actors on the power supply side Power generation accounts for around 40 percent of total energy use in China. Not only is China the second largest electricity market of the world, with a total capacity of 622 GW. China's investment in the electricity sector accounts for a quarter for the world's total power investment. Thus, this paper will put a special focus on electricity supply. China is characterized by serious regional differences in power production and consumption. While approximately 90 percent of the resources used for power generation can be found in inland provinces, most of the energy is consumed in coastal regions. Overall energy policy and strategy is in the hands of the powerful National Development and Reform Commission (NDRC), which has an Energy Bureau. The State Electricity Regulatory Commission also plays a growing role in power sector reform and competition. However, the practical task of ensuring the smooth supply of the entire Chinese territory – with the exception of the southern part – has been given to the State Grid Corporation of China (or State Grid), state-owned company which manages and supervises power generation, transmission and distribution on 80 percent of the national market. The remaining 20 percent are administered by the China Southern Power Grid. The State Grid is split into numerous regional branches, one of which is the Shanghai Municipal Electric Power Company (SMEPC). Though state influence in the electricity field seems great at a first glance, the private sector also has the opportunity to invest or get involved in joint-ventures with government-owned corporations, especially in the field of power generation (power plants). Furthermore, many previously state-dominated energy enterprises have been restructured to modern companies to enhance competition on the domestic market. (2) Shanghai's energy supply situation Shanghai Municipal Electric Power Company (SMEPC) has been able to deliver up to 21'208 MW (4) of electricity, which represent an increase of 1'500 MW since 2006. SMEPC is proud of its power reliability rate, which lies at 99.982 percent. This number is comparable to the French rate of 99.984 percent but is much more impressive if the rapid expansion of the network is taken into account. Total investment by the company amounts to 19'885 billion RMB (2'744 billion USD) in 2007, which gives a hint of the substantial scale of SMEPC's expansion plans. In fact, these numbers are in accordance to predictions of a 10 percent growth in electricity demand in the Shanghai area. This growth rate is higher than the China-wide prediction of the IAE, which expects power supply and demand to increase with an average of 7.8 percent until 2015. SMEPC expects the Shanghai's needs to stabilize at 44'000 MW, out of which 20'000 MW will be produced in the Municipality of Shanghai. Quite surprisingly, more than two thirds of the electricity consumed in Shanghai is also produced in the Shanghai Municipality. Thus, out of the 21'000 MW needed in peak seasons, 14'000 MW can be produced in Shanghai. The remaining 8'000 MW are imported from other provinces. Approximately 82 percent of Shanghai's locally produced power is generated by coal-fired plants. This percentage reflects the approximate China-wide percentage of coal-fired plants and demonstrates that China still heavily relies on coal for its electricity generation. This is due to the fact that China has proven to have the third largest world coal reserves which amount to 1,034.5 billion tons. Since 2000, China was forced to raise the share of power produced through coal from 70 percent to the current 80 percent to avoid power shortages. Now, more than two thirds of Chinese coal is used in the power industry. (3) The coal issue Coal imported to Shanghai comes from inland regions, mainly Shanxi, Inner Mongolia, Shaanxi, Ningxia and Guizhou. Shanghai can import some of its coal through the Huangpu and Yangzhe river mouth waterways. This is unlike most of the cities without developed waterways which have to rely on rail freight (5). As maximum freight capacities for the railway have been reached in many areas, coal is increasingly transported with trucks to coal-fired power plants. This not only increases the cost of transportation but also requires more fuel and oil to be used for the transport. This would make coal-based power production even more environmentally unfriendly, although a lot of progress has been made in improving environmental standards for power plants. Dust filters have now been installed on nearly 100 percent of coal-fuelled generating units. In Shanghai, 14 coal-fired plants which produce a total of 9.572 GW should complete fume desulphurization until 2010. This is an important step towards reducing SO2 and other particle emissions, whose main origin is the coal industry. As coal has often been criticized for its higher impact on environment, China has made the move to close down smaller old-fashioned coal-fired plants to open bigger high technology ones which not only have higher capacities but are also more energy efficient. In fact, the older coal-fired plants are estimated to consume 30 to 50 percent more coal than newer models. While they make up for half of China's yearly coal use, they can only generate 30 percent of China's total power supply. Recently, the NDRC has declared it would close down 553 small heavily polluting thermal power units which represent a total power generation capacity of 14.38 GW. This is 44 percent more than the 2007 target. With the replacement of old power plants for high-technology ones, China hopes to save more than 90 million tons of coal, 1.8 million tons of SO2 and 220 million tons of CO2. For Shanghai Municipality, seven power plants with small generation units of 2.108 GW shall be shut down during the 11th Five Year Plan (until 2010). First on the list are the Nanshi Power Plant (two generator sets) and Wujing Old Plant (see Fig. 1). Fig. 1: List of power plant closures for Shanghai

Source: Shanghai Municipality (2007).

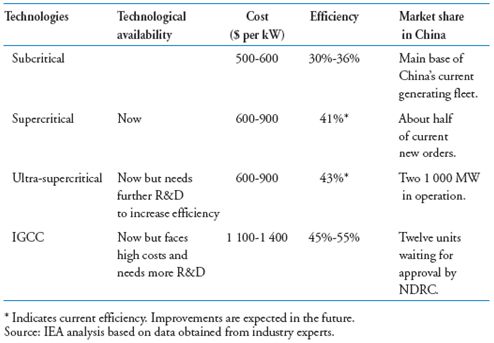

As just mentioned, a great part of investments flow in building new high-technology power plants to replace the older ones. The government is giving now priority to new power units above 300 MW. Yet, it must be mentioned that most of the newly built electricity plants rely on coal. Shenergy, a company founded and partially financed by the Chinese government, is a good example of a company investing in power generation jointly with the State Grid. As compensation, Shenergy gets the right to distribute and sell part of the electricity produced by these generators. It is now in charge of approximately one quarter of Shanghai's total electricity supply. Electric companies are thus now capable of investing in high-technology supercritical or ultrasupercritical power generators of capacities between 900 MW and 1'000 MW. However, classical capacity lies between 300 and 600 MW. By using generators with the latest technology, it is estimated that coal consumption per kW could be lowered from 615 g to 299 g. The most famous project in high-technology power generators near Shanghai is the Shanghai Waigaoqiao Power Plant which possesses two 900 MW generators (already in operation). Two further generators of 1000 MW are due to be completed and connected to the Grid in February 2008. Fig. 2 gives an overview of current coal-based power generation technologies in China. As can be retrieved from this table, efficiency improvement potential due to new generators is high and the IAE estimates that efficiency of coal-fired generation could rise from 32 percent in 2005 to 39 percent in 2030. Fig. 2: Coal-based Power Generation Technology in China

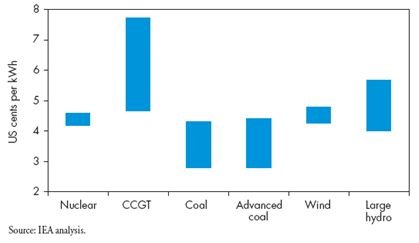

(4) Hydropower The 8'000 MW of Shanghai's imported power are mainly generated by the Three Gorges Dam, which was able to supply the city with 4'200 MW last year. The completion of the dam in 2009 will enable Shanghai to import even greater amounts of hydropower. In fact, the Three Gorges dam will be able to deliver a capacity of 18.2 GW after completion. Shanghai is interested in importing more hydropower – which is considered as a renewable and clean energy – to reduce its controversial high share of coal-generated power. Indeed, China's target energy mix for 2010 anchored in the 11th Year Plan is composed of: 66.1 % coal, 20.5 % oil, 6.8 % hydropower, 5.3 % natural gas, 0.9 % nuclear power and 0.4 % other renewables. The Chinese government plans to generate 300 GW with hydropower by 2030. This is due to the fact that 12 percent of the world hydropower resources are located in China, which makes it the country with the world's highest hydropower potential. The Three Gorges dam, although it is the most known project, is only one of many other hydropower projects in the country. Two more large-scale hydro-projects are under way. The Xiluodu project (south-western China) will have a total capacity of 12.6 GW in 2015. But more relevant for Shanghai is the Xiangjiaba project in Sichuan province, also planned in 2015, which will generate a total of 6 GW. However, it is necessary to point out that small-scale hydropower plants also have a consequent share in hydropower production, which sums up to 50 GW. (5) Nuclear power and other renewables (wind and solar power) The Chinese government is now promoting the use of energies such as nuclear, wind and solar power. Shanghai's power companies are now financing nuclear power plant projects in nearby provinces. One illustration is the Qinshan nuclear power plant in Zhejiang province, which disposes of two 650 MW reactors and is planning two more 700 MW reactors. Shenergy, who has invested in this power company, will be able to import 1000 MW to Shanghai for distribution. The Chinese government is now making efforts to promote renewable energies. For this, a Renewable Energy Law was put into place on January 1, 2006 to make the connection of power plants producing electricity from renewable energies compulsory. This ensures that all renewable energy must be purchased. For solar energy, the target of Shanghai Municipality is to reach a production of 10 MW until 2010. For China as a whole, this target is at 300 MW in 2010. The costs of solar generation, however, as so high (as we will see later) that this energy is likely to stay insignificant in the future. While China tries to promote clean energies, it must be noted that the main goal will remain ensuring power supply security. Even state authorities acknowledge that renewable energies will only play a marginal role in the future, especially because of higher generation costs. Thus, practice might be a little different from the good intentions formulated by central government. (6) Producer cost and pricing As can be seen from the previous example of wind power, there are considerable differences in the cost of producing the various energies. Fig. 3 gives a better idea of the production cost per kWh. The graph clearly shows that coal remains the cheapest way to generate power, costing approximately 0.035 USD per kWh. This explains why China still sticks to its coal-fired power plants. Nuclear power comes next, being approximately 1.5 times as expensive. The main explanation for the higher generation price of nuclear power lies in the nuclear plants' construction cost of 1500 to 1800 USD per kW of installed capacity. As a comparison, the construction costs for a high-technology coal-fired power plant hover around 600 and 900 USD per kW of installed capacity. Fig. 3 : Plant Generation costs in China

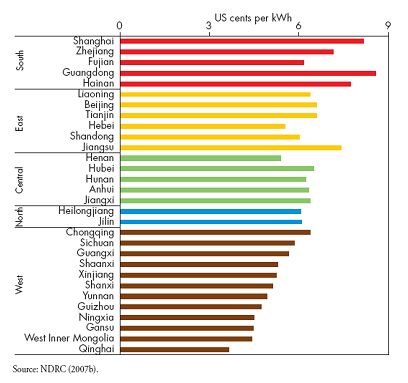

Wind and large hydropower plants are 1.5 to 2 times more expensive as coal (6). Many experts, however, assess that wind prices could be lowered in the near future due to a more intense competition between domestic wind turbine producers. This is due to the fact that until now, 80 percent of the turbine components had to be imported. The initial investment costs in turbines, which make up for about 80 percent of the costs, could thus be lowered if more parts could be manufactured in China. One main challenge, though, is that some of the Chinese turbines do not reach the ideal quality standards. Power generation using natural gas (CCGT), which now represents one percent of power generation, is more expensive, approaching twice the price of coal-based power. However, power originating from gas is estimated to reach 4 percent of the energy mix in 2030. Solar power has not been indicated on the graph but is approximately 4.5 times more expensive than coal and has very high maintenance costs. The coal price at which coal-fired power plants will be supplied is negotiated according to market supply and demand shortly before the start of a new calendar year. This shows that coal combines both planning elements while being subject to market competition. Quantities allocated to each power firm are also fixed in the same process. This necessitates good predictions of the power demand for the following year from the side of regional grids. In case of an unforeseen power demand from the consumer side, regional branches of the State Grid have the possibility to purchase power from other provinces, as all six major regional grids are interconnected. However, to “punish” wrong calculations, regional branches have to buy the power at the full price of approximately 1 RMB (0.138 USD) from their neighbours. This policy forces them to make losses, as the end-user price is lower. Coal demand is booming - mostly because of a rise in power demand - and cannot be covered by a similar increase of coal production (only 8 percent increase), so that prices have to adjust accordingly. Even if coal is the cheapest way to produce electricity, the coal price rose by 10 percent between 2007 and 2008 and is of great concern for power firms. Some power producers already fear to operate at a loss, especially those which produce in regions with relatively low end-consumer electricity prices. Although Shanghai exhibits the highest end-use power prices (see Fig. 4), transportation costs have to be considered. The reason of concern is the fact that the state wants to freeze power prices although coal prices continue to grow. This state policy is due to rising concerns about high inflation, with consumer prices reaching an eleven year high of 6.9 percent at the beginning of 2008. The Chinese government fears that a price increase will put too much pressure on ordinary or low-income Chinese citizens, eroding their purchasing power. Electricity price stagnation is nothing new for Shanghai, who boasts that the price per Watt has not changed for ten years. The energy price for the industry has grown by 0.2 RMB (0.0276 USD) per Watt in the last ten years to reach an average of 0.7 RMB (0.0966 USD) in 2007. Fig. 4: End-Use Prices by Region and Province, 2006

As the end-consumer energy price is the same regardless how it has been generated, power companies have no real incentives to switch to cleaner and renewable energies. The example of coal has shown that the power firms' profits are already melting, but the situation will only be worse for other lower-margin energies such as wind. Until now, the government has failed to subsidize renewable energies to set the right incentives to power firms. The only measure which has been taken has been to issue a regulation which forces power firms whose production exceeds 5 GW to generate 3 percent of their power with renewable energies starting in 2008. This compulsory share of renewable energies should rise to 8 percent in 2020. Keeping end-use prices at a low level which does not reflect the evolution of primary resource prices also gives no incentive to industries and other big consumers to launch energy-saving programmes to curb their energy demand. Shanghai Municipality, however, has formulated its intention to introduce differentiated power prices to discriminate against energy guzzling or old-fashioned industries. This would give them the incentives to either improve their energy efficiency or close down. Unfortunately, practices in other regions have shown that local governments give priority to economic development, job creation and tax revenues, seeing environmental concerns as secondary. Very often, waivers are given to energy intensive industries. Furthermore, although the Chinese government is now making the move to improve the environmental friendliness of its development, the external costs of coal pollution are not taken into account. 3. Gas situation in Shanghai (1) Demand Growing urbanisation and wealth accumulation in coastal areas have made for the natural gas demand surge in the residential sector. Natural gas is used not only for heating in the northern part of the country, but also mainly for cooking and hot water showers. The IEA estimates that natural gas demand has been increasing by an average of 6.4 percent in recent years. This figure is even higher for residential areas, where it lies at 10 percent. The region of Shanghai was composed of around 5 million natural gas consumers at the beginning of 2007. Both households and industries consume more than 2.7 bcm (billion cubic metres) per year. Following the overall China trend, consumption for Shanghai is bound to reach 6 to 7 bcm in 2010. Even one chief executive of Shenergy sees these official numbers as very cautious and would rather estimate gas demand to reach 12 bcm in 2015. Increased living standards only provide a limited explanation for this steep rise in demand. In fact, Chinese government is favouring the extension of the domestic natural gas network as it is considered a cleaner energy. Thus, efforts are made to increase the population's access to natural gas, especially in populated areas. The number of urban residents with access to gas more than doubled in the last five years, the coastal areas accounting for more than half of this growth. The number of cities with gas distribution is expected to rise to 270 in 2010. (2) Supply The increasing natural gas demand has to be matched with a proportional increase in supply. China's natural gas reserves, of which 90 percent are located onshore, sum up to 2 percent of the world's reserves. The Shanghai region relies more on offshore extracted natural gas: 2 bcm have to be imported from Xinjiang while 0.7 bcm come from an offshore platform in the China Sea. Most of Shanghai's natural gas is distributed by the company Shenergy, who owns a 95 percent market share in natural gas pipeline distribution. While some areas in Shanghai can be delivered with pipelines, remote areas have to rely on gas cylinders. Unfortunately, China's domestic natural gas production does not suffice to cover the demand on the Chinese market. Hence, China is now investing in building capacities to import Liquefied Natural Gas (LNG). For Shanghai, a special LNG regasification terminal is being built at the Yangshan deep water port and will allow Shanghai to import 1.65 million tons of LNG starting in 2009. Although the import of natural gas has been capped at 6 million tons per year, this amount will have to grow in the near future. In fact, it is estimated that natural gas imports should reach 100 bcm to cover all of the coastal regions' needs. Caroline Wehrle Useful sources: International Energy Agency (2007). World Energy Outlook 2007: China and India Insights. Rosen, D. & Houser, T. (2007). China Energy: A Guide for the Perplexed. Shanghai Municipal People's Government (2007). Notice of Shanghai Municipal People's

Government on Printing and Distributing the “Implementation Plan of Shanghai Municipality for Energy-saving and Emission-reduction Work”. State Council (2007). White Paper on Energy. (2) The main drivers of energy consumption are extraction, transport, generation, transmission, distribution, industrial processing and consumption.

30.1.2008 Consulate

General of Switzerland |

Back to the top of the page

Page created and hosted by SinOptic