| Issue N° 7 - December 2008 |

|||

|

When comes spring? Shanghai Real Estate Market braces for cold winter Download Shanghai Flash N° 7/2008 pdf-version

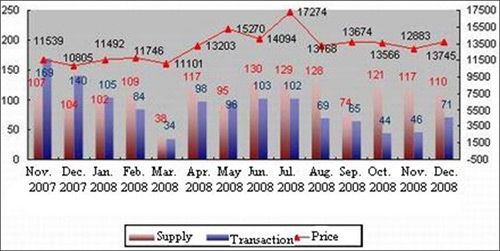

The global financial turmoil is expected to further drag down the world economy, which is suffering a great recession and slowdown from the beginning of 2008. China's GDP growth of the first three quarters fell to 9%, well below last year's 11.9%, lying great negative impact on investment and weakening confidence in China's real estate industry. I. Recent real estate market For the first half of 2008, Shanghai real estate market kept relative stable. The 3rd Quarter marks the inflexion of the whole property market. With the conventional annual real estate boom known in the industry as “golden September, silver October” and the “October golden week holiday” passing stagnantly this autumn in China, the real estate industry is falling into a cold winter. Property prices in China's medium-sized cities began to show a downward trend from the 3rd Quarter. Not many industries can be as both important and hard to manage as real estate. Much of a society's consumer spending is related to the pattern of its real estate market directly or indirectly. According to “Shanghai Master Planning 1999-2020”, the total population will keep 18 million with 85% city level covering 1,500 sq km in Shanghai in 2020. The framework of facility foundation for modernizing and international metropolis should be established in 2020. The real estate industry should be the fundamental guarantee of this plan and the pillar industry of economic development. According to the market survey in the centre of the Yangtze River Delta from the Development and Reform Commission, sales property price below 90 sq. m. of new housing in Shanghai reduced by 0.9% and 0.4% in September and October. The supply of residential market increased by 38%, while trading volume fell by 20%, which causes the proportion between supply and demand ratios reaching an unprecedented 3.3 to 1 1. Considering the continuous fall of residential price and expecting a further fall, people are holding a wait-to-see attitude, which is then a vicious circle.II. Industrial Market Industrial real estate refers to the nature of all land and buildings affixed for industrial purpose, like manufacturing plant, warehouse and logistics industry R&D buildings etc. There was a total of 305,000 sq. m. of new industrial facilities completed in the market for the first half of 2008; therefore the total stock was increased by 3.28% year-on-year. As compared with last year, the supply growth rate slowed down. The decline in new supply led the average vacancy rate of leading industrial parks to remain at a lower level of round 3.5% at the end of first half of 2008. Currently, the average rent of main industrial parks kept steady growth rate of 8.5% year-to-year to RMB 0.89 per sq. m. per day 2. The low price of industrial land made some companies consider another alternative to buy instead of renting. In a relative new industrial park in suburban area of east Shanghai, the land buyers have obtained more profits on land purchasing with a low price and subleasing than renting, benefiting from the appreciation of land.III. Questions Raised by the Stimulus Plan During the first 3 quarters of 2008, ample supply has been put onto the market, among which the bulk of them emerged in the second half of 2008. The negative impacts from the China economic slowdown coupled with the more volatile global market seemed to penetrate the Shanghai Grade A office market till the end of the first half of 2008. New take-up amounted to 186,146 sq. m. in the first half , maintaining vacancy rate at as low as 4.7%. However, the figure rose to 9.8% 3 from the 3rd Quarter, which is unprecedented high since 2004. Meanwhile, the average rent kept rising to RMB 9.9 per sq m per day, a 11.7% rise than on the year-on-year basis. Great pressure is laid on Pudong, as remarkable office building is put into use this year like Shanghai International Financial Centre(210,000 sq m) with 50% vacancy rate, Mirae Asset Tower(51,800 sq m). Positioned as the financial and trade centre, Pudong Lujiazui area, is expected to attract more lessee and expands its convergent function. The record-breaking high vacancy rate in recent years is closely related to the worsening external environment. A number of multinational enterprises would bring down their business target and reduce office demands with more preferential re-let offering. What's more, investors begin to withdraw their speculative funds after domestic tightening policies on foreign hot money.IV. Retail Market From late 2007 to middle 2008, despite the continued pressure of inflation, total retail sales of consumer goods grew rapidly and per capita income kept rising. In the second half year of 2008, Shanghai retail property market will be sustained. In Pudong, new supply of retail property will meet the local growing need concerning with the maturity of residential and commercial areas. In the next half year, round 202,600 sq m of shopping centre space will be launched in Shanghai property market. V. Residential Market Trend of Shanghai Residential Market from 2007-2008

Policy at the national level China is witnessing a down-turn in the growth of property-related fixed-asset investment while the global recession makes it urgent for China to rely more on domestic demand for economic growth. As a result, the central government and local governments at all levels attach great importance to this industry and a number of major Chinese cities have recently take actions to boost local real estate markets: offer a preferential subsidy for first-home buyers, cancel restrictions on a second private property or reduce property tax. For the first half of 2008 there is no tightening policy issued in the real estate market, however the continuous stringent loan policy was a negative effect to real estate developers in obtaining funding. To prevent further declines in property prices and to protect the industry, on Oct. 23, 2008 the Chinese Ministry of Finance and central bank announced to lower deed taxes4, reduce down payments and lower mortgage rates, aiming at increasing consumption to shore up the national economy amid the global and domestic economic slowdown.

Shanghai Local Policy

The implementation of the encouraging measures may have more positive impacts on the property market for balancing demand and supply of the property market. On the one hand, the policies would be positive to stimulating demand, as the reduced transaction cost in subsequent re-sale of the property would induce more potential buyers to enter the market. On the other hand, the lower transaction cost would also encourage more sellers to put their property onto the secondary market for sale. The measures therefore should be able to stimulate market activity. As especially emphasized in the rules, the definition of “ordinary house” is essential to the beneficiary group. It is mainly standard family houses for low to middle-class in Shanghai. Shanghai has released new standards for “ordinary house” on Oct. 24th, 2008, according to which the ordinary houses will be restricted by area(no more than 140 sq. m.) and unit price(depending on different areas) together. Under the new standards, the supply of ordinary houses has increased by a large amount. Transaction volume of second-hand homes rose in November in Shanghai though average prices continued to decline compared by October. 4. Deed Tax: A written document, proving the ownership of real property purchased from the government at a Tax Sale. VI. Conclusion The global financial storm is far from dropping away, bringing great uncertainty to domestic economy. According to a report by World Bank, China's economic growth will slow to 7.5 percent next year from 9.4 percent this year—the slowest growth since 1990, reflecting the grim realities of the international financial crisis. Shanghai real estate price, representative of the property price of Chinese top-tier cities, to a large extent is connected with the global and domestic economic situation. From the overall economic situation, it would take a long time for the adjustment in the real estate market, which could hardly rebound in a short term. Winter has already come, but when comes spring? Xu Min Economic Section 16,12.2008 Consulate

General of Switzerland |

Back to the top of the page

Page created and hosted by SinOptic