| Issue N° 4 - November 2007 |

|||

|

China's banking sector with a focus on Shanghai

Download Shanghai Flash N° 4/2007 pdf-version Update on Shanghai's financial system Today's situation on the stock exchange: The casino Shanghai has become a highly speculative market, especially due to the fact that more and more individuals are investing in the stock exchange. Shanghai accounts for approx. 75 percent of the total Chinese market capitalization which is now at 3.6 trillion USD. This is 9 times more than two years ago. From taxi drivers to retired people, many people are lured by the high profits they could earn by investing in stocks. Since April 2007, an average of 300'000 new brokerage accounts has been opened per day. This fact can be explained by the following factors:

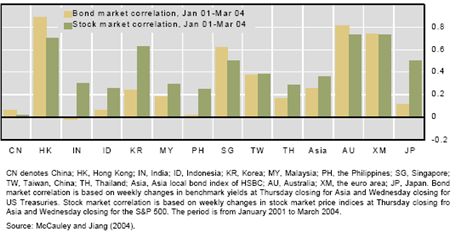

The high volatility in the markets can be spotted by looking at the very high asset turnover. A major challenge is that these individuals, who have no extensive knowledge in the financial markets, see investing on the stock exchange more as a game. They do not have any rational strategy and invest while indexes are soaring up, without any consideration of the firm's real long-term value and profitability. Although many believe that no new correction will happen in the near future, as the Chinese government has no interest of experiencing a slump in the market before the Beijing Olympic Games next summer, these developments fuel fears of a growing bubble which will eventually implode. Shanghai and the world financial system Because of regulations which still restrict foreign investors to invest freely on the China Mainland and although hot money is pouring in, the Shanghai financial centre still looks more like a domestic international centre than an international one. The Shanghai market is nearly closed to international capital flows, so that share prices reflect the domestic market's liquidity, which is very high because of the excess demand for shares. Hong Kong still is the dominant platform for exchanges between China and the rest of the world, not only because of its openness to international investors (no foreign exchange controls) but also because of its better governance, regulation enforcement and advantageous tax system. Although most of the Chinese blue chip companies are listed on the Hong Kong stock exchange and rather more risky shares were traditionally seen to be traded in Mainland China, Shanghai is gaining ground with more and more blue chip companies making the move back to Shanghai A-share market because of even better profit perspectives there. By comparing companies listed both in Shanghai and Hong Kong over the April 2005-April 2007 period, it is possible to see that shares traded in Shanghai exhibit an average premium of 77 percent over the ones traded in Hong Kong, so that investors have a preference for Hong Kong shares that has to be compensated by such a premium. The government is now considering the introduction of share swaps between Hong Kong and Mainland stocks, which has led to expectations that the price gap between A and H-shares will narrow. After this announcement, the Shanghai Composite Index fell down by 3.5 percent. Although the Shanghai financial centre is growing much faster than in Hong Kong, a lot more banking assets as well as foreign exchange and derivatives are traded in Hong Kong. Shanghai, however, is becoming an important centre for commodities trading, which Hong Kong is not. Fig. 1: Bond and stock market correlations with the US stocks

The relatively closed Chinese financial system has shielded the Chinese market from shocks which have happened relatively recently. The American-originated subprime crisis has had negligible impact on the Chinese markets, which have continued their frenetic ascension since then. The combined exposure of the People's Bank of China (PBOC), China Construction Bank (CCB) and the Industrial and Commercial Bank of China (ICBC) adds up to only 12 billion USD. The World Bank however points out that a great part of the losses might be hidden in China's international reserves - which consist mainly from US T-bills - and could amount to 250 billion USD. Fig. 1, although based on 2004 data, exemplifies the low correlation between Chinese and US markets. Challenges to the financial sector and current developments This section aims to highlight a few critical areas concerning the current Chinese banking and financial system and describe what progress was made in these areas. The main banking players: the “Big Four” The Chinese banking system, according to the Shanghai Financial Service Bureau, consists of 800 financial institutions, 350 of which are foreign. Yet, it continues to be dominated by China's four largest state-owned commercial banks, the “Big Four”, who still hold 65 percent of all banking deposits through their 116'000 domestic branches. These are People's Bank of China (PBOC), China Construction Bank (CCB), Industrial and Commercial Bank of China (ICBC) and Agricultural Bank of China (ABC), who will soon all be publicly listed. They still lack advanced competitive structures and lag behind when it comes to profit and customer orientation. However, a lot of progress has been made recently, pushed forward by the opening up of the banking system to foreign competitors, which will be commented on later.

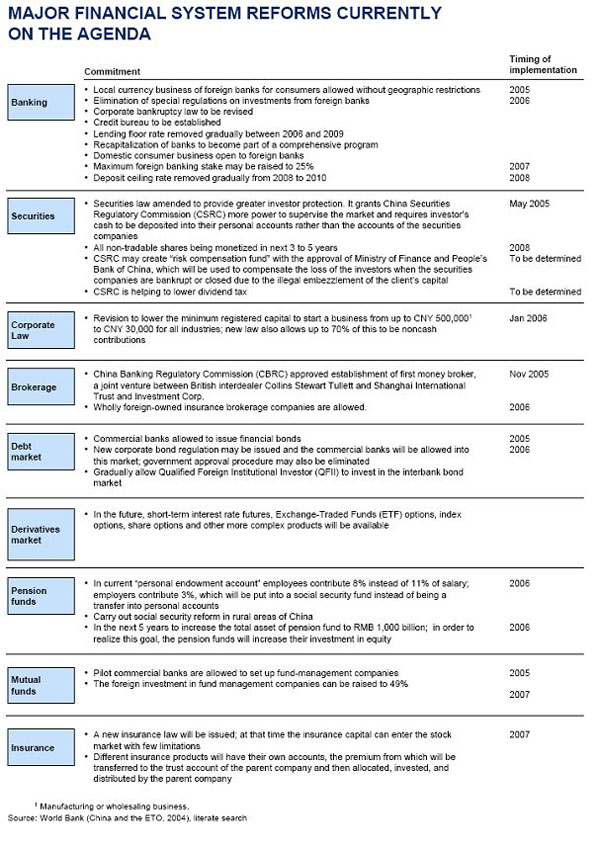

Update on the Non Performing Loans (NPL) situation One major inefficiency of the Chinese banking system are the Non Performing Loans (NPL). Their propagation was favoured by the fact that state-owned banks believed they would always get the help from government in case in financial distress. The Chinese government has now addressed the problem among others by transferring more than 150 billion USD worth of NPLs on state-owned asset management companies like Huarong, Cinda, Great Wall or China Orient. This has lead to a sudden drop of the share of NPL from 33 percent in 2001 to 6.54 percent in June 2007 on the bond market. The problem of NPL, however, is not going to disappear until Chinese financial actors improve their credit rating system and the Chinese government assures that there will be no bailout for state-owned banks. The new Bankruptancy Law, passed by the National People's Congress in 2007, will hopefully improve the situation by ensuring the better respect of creditor rights. Government share ownership and influence over the IPO market Two-thirds of the shares issued on China's domestic exchanges are owned by the government and are legally non-tradable. This implies that the real size of the Chinese Mainland stock markets is much smaller. In 2005, the government has announced a plan of transforming these shares into tradable “G shares” so that this issue remains to be followed in the near future. It can be noticed that it is much easier for a former SOE, due to better connections with state officials, to get government approval for an IPO. Most of the listed firms are hence former SOEs, which use the listing to find capital. Once listed, the strategy of SOEs is to rely entirely on capital markets to grow, instead of focussing on improving the company's core assets. There is a great need to encourage the listing of other private firms, as those are the main contributors to the markets' dynamism. By also reducing the number of state interventions in the system, improving transparency and fighting against corruption as well as insider trading on the Chinese markets, a lot of uncertainty could be removed, which would have a positive effect on the market. Lack of institutional investors in the equity market The lack of institutional investors (i.e. insurance companies, mutual funds, pension funds or hedge funds) is one main reason for today's high volatility of the markets (as seen before). They account for only one-third of the equity trading, compared to 62 percent in the US. Institutional investors would stabilise the market by investing more rationally and considering the long-term real prospects of listed firms. Lack of a developed credit-assessment system Lending is still based in very succinct information. As most of the companies' financial statements are unreliable, as they still do not comply with international standards, it is easy for a company to falsify them. Past experience and relationships are still determinant in this business. Some government-backed banks also do not have sufficient incentives to improve the system. Furthermore, renowned international rating agencies are still absent from the Chinese market. The decentralized structure of the banking system also does not contribute to improving the situation, as many branches from the same bank seem to operate totally independently. Some steps are slowly taken to build national standards and networks for credit assessment: PBOC has sought to develop a credit information database this year, CBRC has urged banks to unify regulations in that matter lately and CSRC has issued the Tentative Procedures for the Administration of Credit Ratings in the Securities Market on August, 24, 2007. However, there is still a lot to do in this field. Improvements will especially be beneficial for household and SME lending, who are still disadvantaged because of the higher risk they represent. However, they also conceal a higher, unexplored potential. Embryonic corporate bonds sector Corporate bonds ensure companies a cheap way of financing their investments. In China however, only 10 percent of the corporate debt comes from bonds. Most firms get their finance from taking bank loans. One reason for that is the tedious approval process for corporate bond issuing, which generally takes between 14 to 17 months. As the interest on corporate bonds gets taxed while the one on government bonds does not, there are no sufficient incentives to buy corporate bonds. Furthermore, the credit-rating system is still at a very early stage, which does not encourage the growth of the corporate bond sector. Prospects for foreign banks in China in consideration of the ongoing financial system reform With China's WTO accession, Chinese authorities have committed themselves to the opening up of their financial sector to foreigners. A wide-ranging series of financial reforms have been undertaken since. A core milestone to this reform is the new Foreign-Invested Bank Administrative Rules which have been put into place on December, 11, 2006. These reforms, however, must also be seen as a step by the Chinese regulatory bodies to improve competitiveness and efficiency in the Chinese banking market. This move towards liberalization opens up many opportunities for foreign banks. Promising areas for foreign banks are wealth management, e-banking, mortgage lending and credit card issuance among others (see Box 2 on wealth management). These opportunities, however, always have to be considered with the regulatory background in mind, which still considerably hinders the foreign banks' rapid setting up of operations in China. As the detailed listing of all measures of the financial system would go beyond the scope of this introductory paper, only a few changes central to the current reform have been picked out. For a more comprehensive overview and timeline of the financial sector reform, please have a look at Appendix B. Foreign bank participation on the Chinese market The Shanghai banking sector now includes 100 foreign operational bank institutions in Shanghai who have opened 106 representative offices. Foreign bank total assets amount to 68.2 billion USD, accounting for 14% of the total assets of financial institutions in Shanghai and 56% of the total assets of foreign banks in China. Yet, important regulatory hurdles for the foreign banks' operations still exist. In particular, a single bank cannot acquire more than 20 percent as a minority investor in Chinese banks. This percentage, though it might be increased by 5 percent soon (see Appendix B), is not enough to exercise sufficient control over the decision-making structure and leaves the foreign banks with limited room to influence the Chinese banks' strategy. Some brighter developments stem from the China Banking Regulatory Commission (CBRC) who has now given its green light to already 4 foreign banks (Citibank, HSBC, Standard Chartered Bank and Bank of East Asia) to conduct RMB business with all individuals. 8 others are to follow soon. The main criteria to get a license are to incorporate in China and to provide a minimum capital of 1 Billion RMB. This permission from CBRC opens up a lot of perspectives for foreign banks. Box 2 presents the good prospects of the wealth management business for foreign firms. In the securities field, 20 foreign brokerages, 20 brokerage and fund company joint ventures and 58 representative offices of foreign brokerage are active in Shanghai. However, foreign firms are still subject to limitations in ownership of securities underwriting enterprises. These are a 33 percent limitation in joint-venture securities brokerages and another 49 percent in asset management firms. The government is now continuing its opening up of the domestic market to foreign investors in the framework of the Qualified Foreign Institutional Investor licensing scheme (QFII) which allows foreign investors to trade A-shares. In May 2007, China Securities Regulatory Commission (CSRC) and the State Administration of Foreign Exchange (SAFE) have agreed upon increasing the quota for QFII investment from 10 billion USD to 30 billion USD by December 2007. The total amount of approved QFII now adds up to 52. This number will surely grow in the near future, as CRSC, SAFE and PBOC have announced the lowering of the threshold for participation in the QFII scheme from 10 million USD and 30 years of experience to 5 million USD and 5 years of experience. The QFII investors will also be allowed to contract with up to 3 brokerage firms (compared to 1 before) and will be able to hold multiple brokerage accounts. Domestic investors' participation on international markets In April 2006, the government has approved the Qualified Domestic Institutional Investor (QDII) program which allows Chinese investors to invest in overseas products. CSRC is also in the process of enlarging the scope of the QDII program, which could contribute to curb the RMB appreciation. However, up to now, only 5 percent of China's 18.5 billion USD quota has been used, mostly for investment in H-shares. This can be explained by the fact that the appreciation expectation of the RMB has deterred many Chinese investors from investing abroad.

Since August 2007, the State Administration of Foreign Exchange (SAFE) is planning a pilot program to enable Chinese residents to invest freely in Hong Kong shares when contracting an account at the Bank of China's Tianjin branch. By opening an account at PBOC's Tianjin branch, the investment amount will not be subject to the yearly 50'000 USD limitation on the purchase of foreign exchange. In practice, a PBOC Tianjin account can be opened from any PBOC branch and will enable Mainland residents to invest overseas. The H-shares have soared up in anticipation of an eventual new flood of money coming from the Chinese mainland. Although this project is still on hold, this move bears a great potential to the relief of appreciation pressures on the RMB as well as to the reduction of the excessive domestic liquidity and foreign exchange reserves. Caroline Wehrle Consulate General of Switzerland in Shanghai Useful sources and internet links: Consulate General of Switzerland (2007). Shanghai's Move towards a Competitive Financial Centre in the WTO Post-accession Era. Shanghai Flash. Available at: International Monetary Fund (2006). The Rise if Foreign Investment in China's Banks – Taking Stock. IMF Working Paper. Available at: International Monetary Fund (2006). Progress in China's Banking Sector Reform: Has Bank Behavior Changed? IMF Working Paper. Available at: KPMG (2007). Retail banking in China: New frontiers. Available at: McKinsey & Company (2006). Putting China's Capital to Work: The Value of Financial System Reform. Available at: Spremann, K. & Lang, S. (2006). Foreign Banks enter China. Available at: US-China Business Council (2007). Financial Services in China: An Overview and Assessment of Reforms and Market Openings, with Recommendations for Further Progress. Available at: Appendix A: The main changes in the new Foreign-Invested Bank Administrative Rules are:

Remaining obstacles for foreign-invested banks:

Appendix B:

19.11.2007 Consulate

General of Switzerland |

Back to the top of the page

Page created and hosted by SinOptic